According to the Dictionary of Business Terms, "risk retention" means the following:

"A method of self-insurance whereby the organization retains a reserve fund for the purpose of offsetting unexpected financial claims."

In the insurance world, risk retention has an even broader meaning. Simply put, every time your policy calls for a deductible, you've retained some of the risk. In fact, risk retention is a common strategy for businesses and individuals alike. Every automobile policy contains deductibles and some auto policy coverage options are even declined (at least for older, fully paid vehicles) such as "Collision" and "Comprehensive." Here again is another form of risk retention. The very act of not insuring something of value is another form of risk retention.

General liability and products/completed operations policies have either deductible or self insurance retentions (SIR), both of which are forms of risk retention. Businesses that select self-insured reserves do so in order to gain more control over the risk(s) that they have retained.

From a financial standpoint, there is very little difference. Whether a business has a $5,000 deductible or $5,000 self insurance retention (SIR), the effects of a claim are the same. The insured must pay the first $5,000 in expenses and/or indemnity payments.

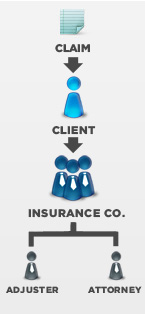

Under a deductible policy, the insurance company controls claims from the date of reporting. The insurance company decides how to investigate the claim and hires the adjuster. It hires the lawyer in the case of a lawsuit and controls the course of litigation. Defendants (the policy holder) get no say in who will represent them and usually have to educate the attorney on their business and products since insurance companies frequently hire "panel counsel" who likely never had a case with that particular product.

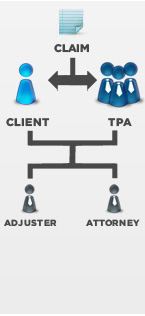

Under an SIR policy, the insured hires a Third Party Administrator (TPA) who administers the claim or lawsuit. The TPA selects the adjuster and communicates directly with the insured regarding the findings. For lawsuits, the TPA hires the attorney who will be representing you and will act as your agent in assisting the attorney in preparing your defense. This both saves time for the insured and often results in lower attorney fees, as well. In short, with an SIR the insured, through a TPA, is better able to control the claims and litigation process.

As explained on our About RRIS web page, Risk Retention Services originally began out of Dan Junius's work with Safe Step, an off-shore captive that sold and issued products liability policies to ladder manufacturers with self insurance retentions. Today, however, Risk Retention Services works with clients under both deductible and SIR policies.

Risk Retention Insurance Services (RRIS) sells both SIR and deductible policies. The choice is up to the client and it is RRIS' goal to find the right insurance program for each client based on their individual needs. And there is no requirement that RRIS clients that do go with an SIR program use RRS either. The choice is up to the client. Of course, we hope they will give serious consideration to using RRS. After all, we have built our company on the basis of doing an extraordinary job in controlling claims and litigation.